Top Down Approach

Let’s start to define what a hedge fund is using a “top down” approach. We’ll look at hedge funds at an investor’s overall portfolio level and highlight some background information. Then we’ll get granular on what a hedge fund is.

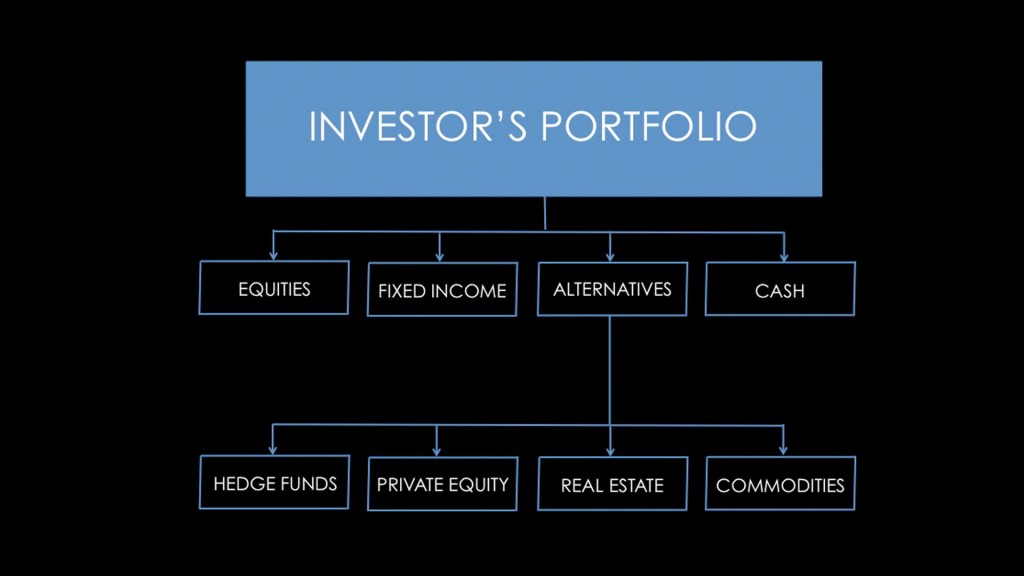

This is a typical investment portfolio that an institutional or high net worth investor manages. It usually consists of seven broad investment categories or what some folks call “asset classes.”

These seven categories include “traditional” investments (equities, fixed income and cash) and what’s referred to as “alternative” investments (hedge funds, private equity, real estate and commodities).

I’ve simplified things here for illustrative purposes and haven’t included things like venture capital which, when compared to the total assets invested by investors into hedge funds or private equity, is often negligible.

Depending on where we are in the economic cycle and where attractive investment opportunities are present, investors and their investment professionals will shift money among these different investment categories or “reallocate” assets from one category to another to meet their investment objectives.

Key Trends

In the US, one of the important portfolio management trends we’ve seen over the last 15-20 years by large investors is a significant increase in alternative investments.

20 years ago, a large investor might have allocated 10 or 15% of its overall portfolio to alternatives investments, usually consisting of real estate and some small percentage of private equity investments.

Today that figure is often much higher, with some large investors allocating as much as 50% of their aggregate portfolio assets into alternative investments including hedge funds.

In the case of hedge funds, the rise in assets and managers has been very dramatic. Today there’s close to $3 trillion dollars being managed by hedge funds globally based on the numbers I’ve seen and, as of September, 2014, there were roughly 2,700 managers that were registered with the SEC that managed at least one hedge fund (and that doesn’t include US and foreign hedge fund managers that for whatever reason weren’t required to be registered with the SEC).

The reasons for this portfolio shift towards hedge funds and other alternatives includes a desire by many investors to try to find “uncorrelated” returns among their different portfolio investments coming off the equity market meltdown in 2000 and the overall market collapse during the 2007-2008 Credit Crisis.

Ownership of these different investment categories often takes one of two forms: An investor either owns a particular asset directly or through some fund entity such as a hedge fund that pools money from different investors and is managed by an investment manager for fees.

Important Consideration

An important consideration with respect to any investment fund is whether that fund is required to be registered with the SEC under a federal securities statute called the Investment Company Act of 1940.

Generally if a fund is required to be registered under the Investment Company Act, it will be subject to restrictions on its operations and its use of certain portfolio management techniques such as leverage.

As its name implies, a hedge fund is a pooled investment vehicle that typically consists of multiple investors and is advised by an investment manager.

Unlike a mutual fund, managers avoid registering hedge funds under the Investment Company Act and thereby avoid the operational and investment restrictions that the statute imposes.

That’s important because hedge fund managers often seek to employ portfolio practices to make money that can’t be limited by any statutory restrictions.

Managers are able to avoid having to register their hedge funds under the Investment Company Act by complying with various private placement rules. They sell hedge fund interests to institutional and high net worth investors that meet certain net worth standards under US securities laws.

Investor Eligibility

There are various “high net worth” tests to determine whether an investor is eligible to buy a hedge fund interest in a private placement.

One popular standard that managers use is the “qualified purchaser” standard, which generally means that individuals must have a minimum of $5 million of investable assets and institutions $25 million in investable assets to be eligible to invest in certain hedge funds.

Because hedge funds aren’t registered under US security laws and their interests are privately placed, you’ll often hear lawyers often refer to them as “private funds.”

The combination of hedge funds not having to register with the SEC as registered funds and their interest being sold pursuant to US private placement rules has important implications for the investment process that we’ll return to in future talks.